The initial Wander Atlas REIT has exited, delivering a strong 22% cumulative return and full liquidity to investors over a 2 year period, proving the institutionalization of the vacation rental industry. If you're interested in participating in a future offering, please join our waitlist.

$18,836,814 total asset value and counting...

creates a unique investing opportunity

Wander REIT buys stunning properties

Smart vacation homes

Modern workstations

Super-fast WiFi

Tesla access

24/7 concierge service

Fitness areas

Hotel-grade cleaning

5-star amenities

Wander booking platform

Wander property management

Wander marketing machine

Wander delivers 5-star guest experiences

Wander REIT pays you quarterly dividends

VIP Status with Wander Concierge at all Wanders

Priority booking for holidays and premium dates

White glove service from investor relations team

Wander REIT investors unlock special perks

Create an account in two clicks to view our prospectus, two-pager and investor presentation.

Wander was built to solve a specific problem and transformed the travel industry. It is a network of smart vacation homes in inspiring places with inspiring views, modern workstations, hotel-grade cleaning and 24/7 concierge service. It’s a vacation home, but better.

Traditional OTAs don't ensure a consistent, high-quality guest experience.

Consumer desire to capture the power of ownership and shared experience as part of a community of travelers.

Strong market tailwinds are supporting compounding growth

An emerging experience generation, paired with the acceleration of existing travel trends.

The Platform, Guest Management, and Asset Management are all separate.

All layers of the travel experience are together.

With a 93%+ customer satisfaction rate across thousands of nights stayed, we’re creating an experience guests truly love.

Guests Britni and Dan talk about their experience at Wander Hudson Valley

Guest Chris Lema talks about the 3 Wander trips he’s booked already...

Alex and Chelsey talks about their Wander Experience

6,300+

NIGHTS BOOKED

1,600+

TOTAL TRIPS

195,000+

ACCOUNTS CREATED

93%+

SATISFACTION

Introducing Wander REIT—the first and only institutional-grade vacation rental investment product—pioneering a better way to reap the benefits of investing in real estate, without the hassle.

Wander REIT brings together the best of Wander vacation homes and REITs. Get in early and unlock access to short-term rentals—the fastest growing segment in real estate—with the potential to deliver above-market returns relative to other established real estate asset classes

Protect your portfolio against inflation with high recurring income and long-term property appreciation.

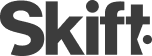

($10,000 minimum)

8 years

Re-investing dividends

EQUITY

$0

4% appreciation / year.

PASSIVE INCOME

$0

Total

Wander REIT invests in a diversified portfolio of Wander homes across 5 markets (and growing), that are managed to optimize the guest experience and drive higher occupancy—benefiting not only guests but also investors.

Spacious oceanfront home in Surfside, South Carolina, with private beach access and breathtaking views of the Atlantic Ocean from nearly every angle. Perfect for your next large gathering, the home comfortably accommodates up to 22 guests with 8 bedrooms, 3 floors and an elevator.

8 bedrooms

3 king beds

4 queen beds

4 bunk beds (8 fulls)

8 full, 2 half bathrooms

15-22

4,276 sqft

Wander Anchor Cove is a modern concrete, glass, and steel home with floor-to-ceiling windows set on 5.25 acres overlooking our own private cove with over 1,800 feet of ocean frontage. This incredible coastal escape overlooks rock formations and islands where you can enjoy the sunset and whale-watching views year-round from the 8-person hot tub, fire pit, or permanent bench on the bluff top.

3 bedrooms

2 king beds

2 bunk beds (Queen-sized lower bunk)

2,751 sqft

3 full bathrooms

Up to 10

5-acre retreat in Mendocino County with 180° views of the California Coast, your own private fitness center, hot tub and barrel sauna. Wood-chip lined trails take you to oceanfront workstations, serene daybeds and outdoor picnic areas.

3 bedrooms

3 king beds

2,751 sqft

3 full bathrooms

Up to 6

Wander Tahoes Slopes is a luxury mountain escape in Tahoe with hot tub, sauna, gym, and access to the world-class amenities at Northstar Resort. Whether you’re craving adventure, or just looking for rest and relaxation, this property has it all like ski-in/ski-out access to the slopes.

3 bedrooms

1 king bed

1 queen bed

1 bunk bed (2 queens)

1 bunk bed (2 Twin XLs)

3 full bathrooms

Up to 8

2,275 sqft

Coastal retreat on a bluff overlooking the Pacific Ocean with a private path to the Bandon beaches and access to nearby world-renowned golf courses. With net zero energy consumption, it is also the first passive home on the Oregon coast and uses advanced technologies to reduce its environmental impact.

2 bedrooms

1 king bed

2 queen beds

1 pull out couch

2 full bathrooms

1,965 sqft

Up to 4

Super modern, glass house set atop cantilevered I-beams and perched on top of a 200 foot cliff. Oceanfront and open concept with stunning floor-to-ceiling views of the Oregon coast.

2 open concept bedrooms

2 king beds

2,600 sqft

2 full bathrooms

Up to 4

Spacious oceanfront home in Surfside, South Carolina, with private beach access and breathtaking views of the Atlantic Ocean from nearly every angle. Perfect for your next large gathering, the home comfortably accommodates up to 22 guests with 8 bedrooms, 3 floors and an elevator.

8 bedrooms

3 king beds

4 queen beds

4 bunk beds (8 fulls)

8 full, 2 half bathrooms

15-22

4,276 sqft

Wander Anchor Cove is a modern concrete, glass, and steel home with floor-to-ceiling windows set on 5.25 acres overlooking our own private cove with over 1,800 feet of ocean frontage. This incredible coastal escape overlooks rock formations and islands where you can enjoy the sunset and whale-watching views year-round from the 8-person hot tub, fire pit, or permanent bench on the bluff top.

3 bedrooms

2 king beds

2 bunk beds (Queen-sized lower bunk)

2,751 sqft

3 full bathrooms

Up to 10

5-acre retreat in Mendocino County with 180° views of the California Coast, your own private fitness center, hot tub and barrel sauna. Wood-chip lined trails take you to oceanfront workstations, serene daybeds and outdoor picnic areas.

3 bedrooms

3 king beds

2,751 sqft

3 full bathrooms

Up to 6

Wander Tahoes Slopes is a luxury mountain escape in Tahoe with hot tub, sauna, gym, and access to the world-class amenities at Northstar Resort. Whether you’re craving adventure, or just looking for rest and relaxation, this property has it all like ski-in/ski-out access to the slopes.

3 bedrooms

1 king bed

1 queen bed

1 bunk bed (2 queens)

1 bunk bed (2 Twin XLs)

3 full bathrooms

Up to 8

2,275 sqft

Coastal retreat on a bluff overlooking the Pacific Ocean with a private path to the Bandon beaches and access to nearby world-renowned golf courses. With net zero energy consumption, it is also the first passive home on the Oregon coast and uses advanced technologies to reduce its environmental impact.

2 bedrooms

1 king bed

2 queen beds

1 pull out couch

2 full bathrooms

1,965 sqft

Up to 4

Super modern, glass house set atop cantilevered I-beams and perched on top of a 200 foot cliff. Oceanfront and open concept with stunning floor-to-ceiling views of the Oregon coast.

2 open concept bedrooms

2 king beds

2,600 sqft

2 full bathrooms

Up to 4

03 Exclusive investor perks

Benefit from exclusive investor perks.

Early access to new properties

Priority booking for premium dates

VIP status when staying at a Wander

Exclusive investor Wander hoodie

Dedicated investor relations team

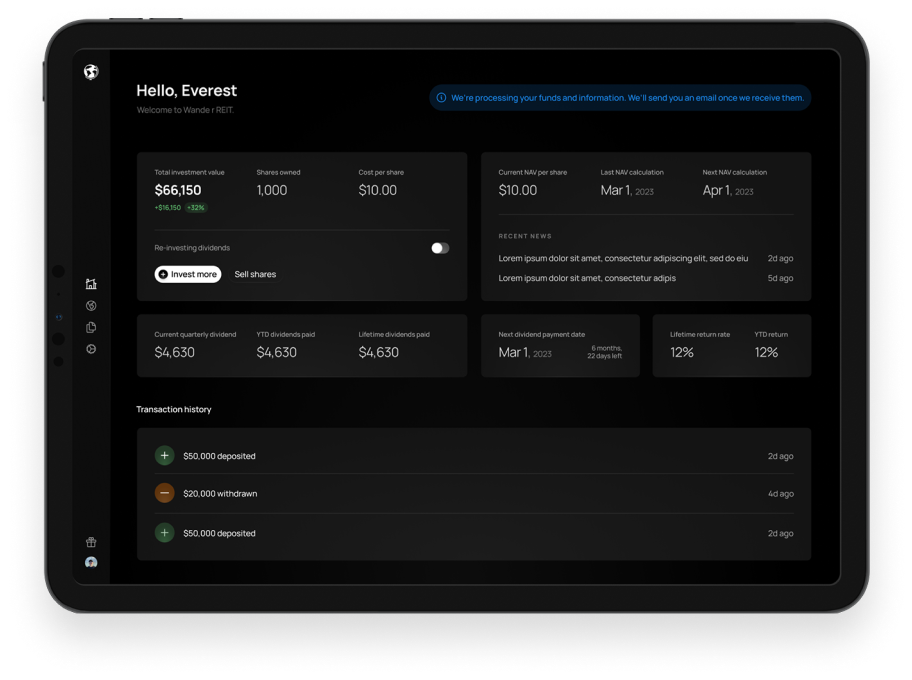

04 Investing made easy

Forget the hassle of buying and managing your vacation rental. Invest in just a few clicks and effortlessly monitor and manage your investment from the Wander REIT dashboard.

The way Wander REIT works is simple. Wander operates the properties and a portion of the rental revenue goes back to investors in the form of quarterly dividends. And if we sell a property the appreciation, if any, does as well.

Data-driven location targeting

Hundreds of opportunities evaluated

Rigorous underwriting process

Licensed appraisers and inspectors

Customized home setup

Property management and upkeep

Advanced booking platform

Full-featured guest services

World-class trip management

Automated payment management

24/7 concierge service

The Wander REIT offers benefits of investing in vacation rentals with none of the hassle. No managing bookings. No changing light bulbs. No cleaning up after guests. Just the potential for quarterly distributions delivered to your bank account.

This description of the Wander Atlas REIT and the related FAQ (the "Materials") has been prepared for informational purposes only, and does not constitute an offer, or the solicitation of an offer, to buy or sell any securities or other financial product, or to participate in any transaction, and should not be deemed to be a recommendation by the Company to buy or sell any securities, to make any investment or to participate in any transaction or trading strategy. These materials remain subject to Company’s review and assessment from a legal, compliance, accounting policy and risk perspective, as appropriate. Neither the Company nor any of its affiliates make any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein is, or shall be relied upon as, a promise or representation whether as to the past, present or future performance. No representations are made as to the accuracy of estimates or returns contained herein, or that such estimates or will be realized. The Materials may contain forward looking statements including statements regarding the Company’s intent, belief or current expectations with respect to the Company’s businesses and operations. Readers are cautioned not to place undue reliance on these forward looking statements. Actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside of the Company’s control, including the effects of the ongoing COVID-19 pandemic, and changes in legislation, among other things. The Company does not undertake any obligation to publicly release the result of any revisions to the forward looking statements in this presentation to reflect the occurrence of unanticipated events.

Wander hopes to provide certain investors in the Wander Atlas REIT the opportunity to invest an upcoming Wander financing round. Notwithstanding the foregoing, neither Wander nor Wander Atlas REIT can in guarantee any Wander Atlas REIT investor will be provided such opportunity. Wander reserves the right to deny, in its sole discretion, any and all Wander Atlas REIT investors the opportunity to participate in any future financing rounds. Wander's ability to allow investors to participate in future financing rounds depends on a number of factors, including, but not limited to, the terms of the financing round and applicable securities laws and regulations. Before participating in any future Wander financing rounds, each prospective Wander investor will have to qualify for the offering under applicable securities laws and will be required to provide supporting documentation to verify their qualifications at the time of the offering.

Past performance of assets to be held by the Wander Atlas REIT does not guarantee future results. Financial information is approximate and as of November 30th, 2022, unless otherwise noted. The words “we”, “us”, and “our” refer to Wander Atlas REIT, Inc., together with its consolidated subsidiaries, including Wander Atlas Operating Partnership, LP (the “Operating Partnership”), unless the context requires otherwise.

Targeted Total Return is a forward looking estimate of potential return assuming a minimum 7-yr hold period, moderate leverage and 2% annual appreciation. It is subject to all of the Risk Factors actors set forth in the PPM including those related to market conditions and the fact that neither Wander or Atlas can guarantee performance or the return on this or any investment. Like any investment, an investment in Atlas entails the risk of loss of some or all of one’s invested capital. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets and in the realization of targeted returns.

1. We cannot guarantee any investor will earn any passive income. Wander Atlas REIT cannot guarantee any return on investment. Like any investment, an investment in Wander Atlas REIT entails the risk of loss of some or all of one’s invested capital.

2. Wander hopes to provide certain investors in Wander Atlas REIT the opportunity to invest in a future Wander financing round. Notwithstanding the foregoing, neither Wander nor Wander Atlas REIT can guarantee any Wander Atlas REIT investor will be provided such opportunity. Wander reserves the right to deny, in its sole discretion, any and all Wander Atlas REIT investors the opportunity to participate in any future financing rounds. Wander’s ability to allow investors to participate in future financing rounds depends on a number of factors, including, but not limited to, the terms of the financing round and applicable securities laws and regulations. Before participating in any future Wander financing rounds, each prospective Wander investor will have to qualify for the offering under applicable securities laws and will be required to provide supporting documentation to verify their qualifications at the time of the offering.

3. Targeted Annual Dividend is defined in the PPM and is forward- looking. In considering the Targeted Annual Dividend please read and consider the Risk Factors beginning on page 37 of the PPM and specifically those Risk Factors discussing the fact that neither Wander or Wander Atlas REIT can guarantee performance or the return on this or any investment. Like any investment, an investment in Wander Atlas REIT entails the risk of loss of some or all of one’s invested capital. Distributions are not guaranteed and may be funded from sources other than cash flow from operations at the discretion of our Board and the Advisor.

4. The term Total Asset Value (“TAV”) involves significant professional judgment. TAV is generally equal to the total purchase price of all Wander Atlas REIT homes (or appraised value, whichever is less), plus actual closing costs, fees, furnishings, fixtures and improvement costs.

5. Targeted Total Return is a forward looking estimate of potential return assuming a minimum 7-yr hold period, moderate leverage and 2% annual appreciation. It is subject to all of the Risk Factors actors set forth in the PPM including those related to market conditions and the fact that neither Wander or Wander Atlas REIT can guarantee performance or the return on this or any investment. Like any investment, an investment in Wander Atlas REIT entails the risk of loss of some or all of one’s invested capital. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets and in the realization of targeted returns.

6. These numbers are for illustrative purposes only and do not represent future or historic returns on an investment in Wander Atlas REIT. Wander Atlas REIT cannot guarantee any return on investment either now or in the future. Like any investment, an investment in Wander Atlas REIT entails the risk of loss of some or all of one’s invested capital. Wander Atlas REIT cannot guarantee any return on investment. Like any investment, an investment in Wander Atlas REIT entails the risk of loss of some or all of one’s invested capital.

7. These numbers are for illustrative purposes only and do not represent historic or predicted returns on any current or prior investment in Wander Atlas REIT. There have been no investments in Wander Atlas REIT to date. Wander Atlas REIT cannot guarantee any return on investment either now or in the future. Like any investment, an investment in Wander Atlas REIT entails the risk of loss of some or all of one’s invested capital. Wander Atlas REIT cannot guarantee any return on investment. Like any investment, an investment in Wander Atlas REIT entails the risk of loss of some or all of one’s invested capital.

8. Wander owns and will likely continue to own and operate certain properties that are not owned by Wander Atlas REIT and from which Wander Atlas REIT will not receive any direct or indirect revenue.

9. Wander operates its homes in the luxury short term rental segment of the market and it anticipates that it will operate properties owned by Wander Atlas REIT in the same sector. Industry sources like Grand View Research estimate the vacation rental market across all accommodation types (excluding hotels but including homes, apartments and condominiums and other accommodations rented on a short term basis) to be approximately $82.63 billion with CAGR of 5.3% from 2022 to 2030. Other sources like Allied Market Research estimate the current market to be closer to $100 billion with estimated CAGR of over 12% from 2022-2030. Even at a 5.3% CAGR the global market is projected to exceed $119 billion dollars in 2030. While we intend to expand globally, at this time all of the homes we own are in the United States which represents about 20% of the global market. Luxury short term rentals are one of the most lucrative and fastest growing segments of the United States market. Wander Atlas REIT cannot guarantee it will enjoy CAGR in any range projected by market researchers.

10. Not all assets operated by Wander will be owned by Wander Atlas REIT. Wander will own and operate certain properties that are not owned by Wander Atlas REIT and from which Wander Atlas REIT will not receive any direct or indirect revenue.

____________________________________________________________________

Important Disclosure Information

Alternative investments often are speculative, typically have higher fees than traditional investments, often include a high degree of risk and are appropriate only for eligible, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time. They may be highly illiquid and can engage in leverage and other speculative practices that may increase volatility and risk of loss.

Alternative investments involve complex tax structures, tax inefficient investing, and delays in distributing important tax information. Individual funds have specific risks related to their investment programs that will vary from fund to fund. Investors should consult their own tax and legal advisors as we will not provide any tax or legal advice. REITs are generally not taxed at the corporate level to the extent they distribute all of their taxable income in the form of dividends. Ordinary income dividends are taxed at individual tax rates and distributions may be subject to state tax. Each investor’s tax considerations are different and consulting a tax advisor is recommended. Any of the data provided herein should not be construed as investment, tax, accounting or legal advice.

Interests in alternative investment products are not (1) FDIC-insured, (2) deposits or other obligations of Wander Atlas REIT or any of its affiliates, and (3) are not guaranteed by Wander Atlas REIT or its affiliates. Wander Atlas REIT is not a bank.

Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED IN THE PROSPECTUS FOR THE OFFERING (THE “WANDER REI PROSPECTUS”). NO OFFERING IS MADE TO ANY INDIVIDUAL WHO HAS NOT, AT A MINIMUM, REVIEWED THE WANDER ATLAS REIT PROSPECTUS IN ITS ENTIRETY. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THE WANDER ALTAS REIT PROSPECTUS IS TRUTHFUL OR COMPLETE. IN ADDITION, NO ATTORNEY GENERAL OF ANY STATE HAS PASSED ON OR ENDORSED THE MERITS OF THE OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

CERTAIN INFORMATION CONTAINED IN THIS COMMUNICATION CONSTITUTES “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF THE FEDERAL SECURITIES LAWS AND THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. THESE FORWARD-LOOKING STATEMENTS CAN BE IDENTIFIED BY THE USE OF FORWARD LOOKING TERMINOLOGY, SUCH AS “OUTLOOK,” “INDICATOR,” “BELIEVES,” “EXPECTS,” “POTENTIAL,” “CONTINUES,” “IDENTIFIED,” “MAY,” “WILL,” “SHOULD,” “SEEKS,” “APPROXIMATELY,” “PREDICTS,” “INTENDS,” “PLANS,” “ESTIMATES,” “ANTICIPATES”, “CONFIDENT,” “CONVICTION,” OR THE NEGATIVE VERSIONS OF THESE WORDS OR OTHER COMPARABLE WORDS THEREOF. THESE MAY INCLUDE FINANCIAL ESTIMATES AND THEIR UNDERLYING ASSUMPTIONS, STATEMENTS ABOUT PLANS, OBJECTIVES AND EXPECTATIONS WITH RESPECT TO FUTURE OPERATIONS. SUCH FORWARD-LOOKING STATEMENTS ARE INHERENTLY UNCERTAIN AND THERE ARE OR MAY BE IMPORTANT FACTORS THAT COULD CAUSE ACTUAL OUTCOMES OR RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED IN SUCH STATEMENTS. WANDER ATLAS REIT BELIEVES THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO, THE EFFECTS OF THE ONGOING COVID-19 PANDEMIC, CHANGES IN LEGISLATION AND THOSE DESCRIBED UNDER THE SECTION ENTITLED “RISK FACTORS” IN THE WANDER ATLAS REIT PROSPECTUS. WANDER ATLAS REIT DOES NOT UNDERTAKES ANY OBLIGATION TO PUBLICLY UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS IN THE MATERIALS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE DEVELOPMENTS, THE OCCURRENCE OF UNANTICIPATED EVENTS OR OTHERWISE.

This website must be read in conjunction with the Wander Atlas REIT Prospectus in order to fully understand all the implications and risks of an investment in Wander Atlas REIT. Please refer to the Wander Atlas REIT Prospectus for more information regarding state suitability standards and consult a financial professional for share availability and appropriateness.

____________________________________________________________________